Disruptive change in motor insurance

The auto industry is facing enormous upheaval: new mobility models are already a reality, and huge amounts of resources are being invested both by OEMs and technology firms in autonomous drive vehicles. While insurers clearly see the opportunity from telematics-driven black box insurance, few seem to have looked much beyond this at the wider revenue possibilities, or considered the longer term impact on product, required competencies and distribution model.

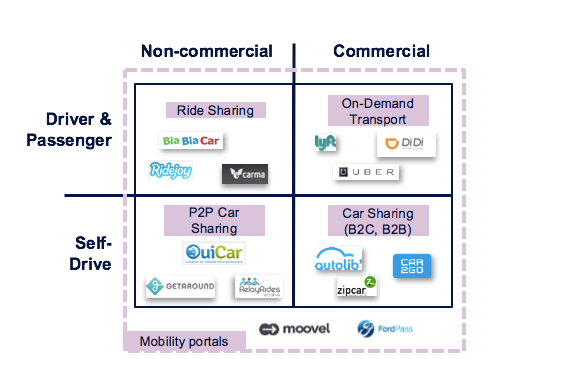

Right now, we see four different mobility segments that already require innovative insurance products: the emerging need in each is for on-demand micro-premiums and the ability to cover multiple parties – platform owners, asset owners, driver and passengers – in an insurance package that is suitable for fleet-like usage and centralised purchase.

Navigating a path through all this is a tall order in of itself, but is just the beginning. In the longer term, new ownership and usage models for cars may progressively eliminate the need for personal motor insurance altogether. Instead, as cars become more and more autonomous, insurance risk will become simply a function of km travelled per annum, and what control software a vehicle is running, while accident rates are expected to fall, driving down both premium income and margins.

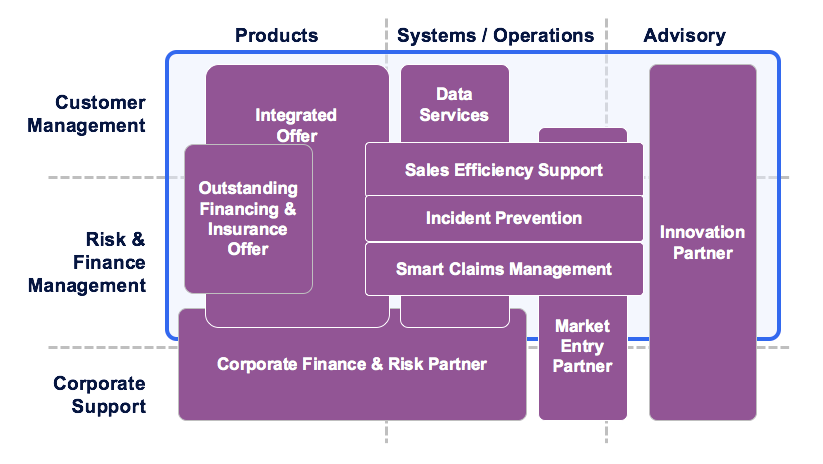

Insurers will need to radically shift their business models simply to replace lost premium income, never mind continue to deliver growth. In the future, we see ten distinct insurance-related propositions emerging in the auto arena, and believe that partnership-intermediated business will become an increasingly important route to market, as insurance becomes more of a B2B2C operation.

Although the pace of the shift to this new world remains uncertain, the direction of travel is not. Traditional insurers need to start thinking now about how they will position themselves within the new automotive ecosystem, because they will need all the time they have available to overcome the many challenges they face, including:

An invariably highly product siloed way of doing business at present

Inflexible IT platforms

Lack of organisational agility and adaptability

Lack of significant innovation capability

In addition, they need to start thinking about what partners they need to bring on board, and how best to do this – and few have experience in this area, either. An additional complexity is that the partnership approach required will vary depending on the type of partner entity involved, whether it be a digital start-up, a traditional OEM or one of the major existing mobility players.

These different versions of partnership lie between the extremes of creating in-house capability and merely buying from a supplier. In a world of ecosystems, where innovative end customer propositions are increasingly formed from the sum of parts provided by numerous entities, insurers need to industrialise the process of identification and on-boarding of the partners they will need.

As part of our work in this area we have created a simple nine step approach to doing this. As articulated below the approach assumes the insurer is pitching itself to potential partners, but essentially the same steps apply if the insurer is looking for partners to support its own innovation initiatives – something that is simply the other side of the same coin.

Identification: identify potential partners by understanding their needs and the fit to your own existing or potential capabilities.

Fact find: early discussions to establish partner interest, knowledge and capability in the relevant space – are they as good a potential partner as first thought?

Pre-selection: both parties disclose further materials, allowing a more thorough initial evaluation of competency, relevant knowledge, cultural fit, and whether a co-operative alliance is possible.

Initial expression of interest: define the areas of engagement and write an initial proposal outlining what will be provided and received by each party.

Relationship specification: detailed specification of involvement options, functional roles, funding arrangements, initial position on branding, IP, and so on.

Choice criteria: evaluate panel of potential partners on direct opportunity offered, additional value, and cultural fit.

Provisional working agreement: specify relationship principles, ways of working, value sharing, governance structure, and exit process as a minimum. At this point, agree a Memorandum of Understanding.

Early stage collaboration: collaboration in a limited way to show tangible benefits for both parties, and align expectations ahead of a full agreement.

Full partnership agreement: once the benefits to both parties have been demonstrated to the satisfaction of each.

In summary, the world of motor insurance is changing, and insurers need to be ready. The exact details of the new world are not yet fixed, but change is coming and the one certainty is that if traditional insurers wait for the picture to clarify, they will find they have been left behind by more adaptable competitors, and the best ecosystem partners will all be taken.

To further discuss any of the issues outlined here, please feel free to contact the author.